John’s Substack

November 30, 2023

Net Present Value

A framework for 2024 planning in Customer Success.

Net Present Value isn’t a topic we often discuss in Customer Success, or, for that matter, in SaaS leadership. For most of us, our days are filled with talk of ARR, NRR, GRR, Payback Periods, LTV/CAC, Magic Number, and perhaps even the Rule of 40. We plead our case for budget, highlighting that just a bit of funding for a key project or one more rep will increase ARR, improve retention rates, or make our business more efficient. However, it's rare for us to discuss Net Present Value (NPV) – but we should.

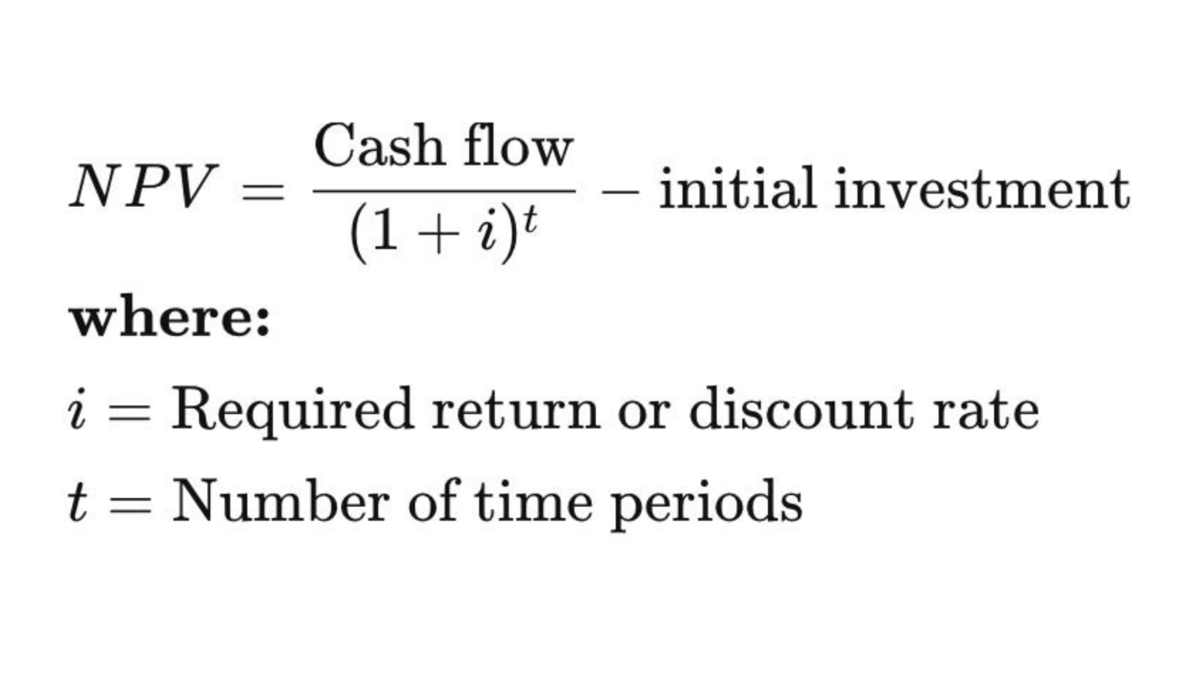

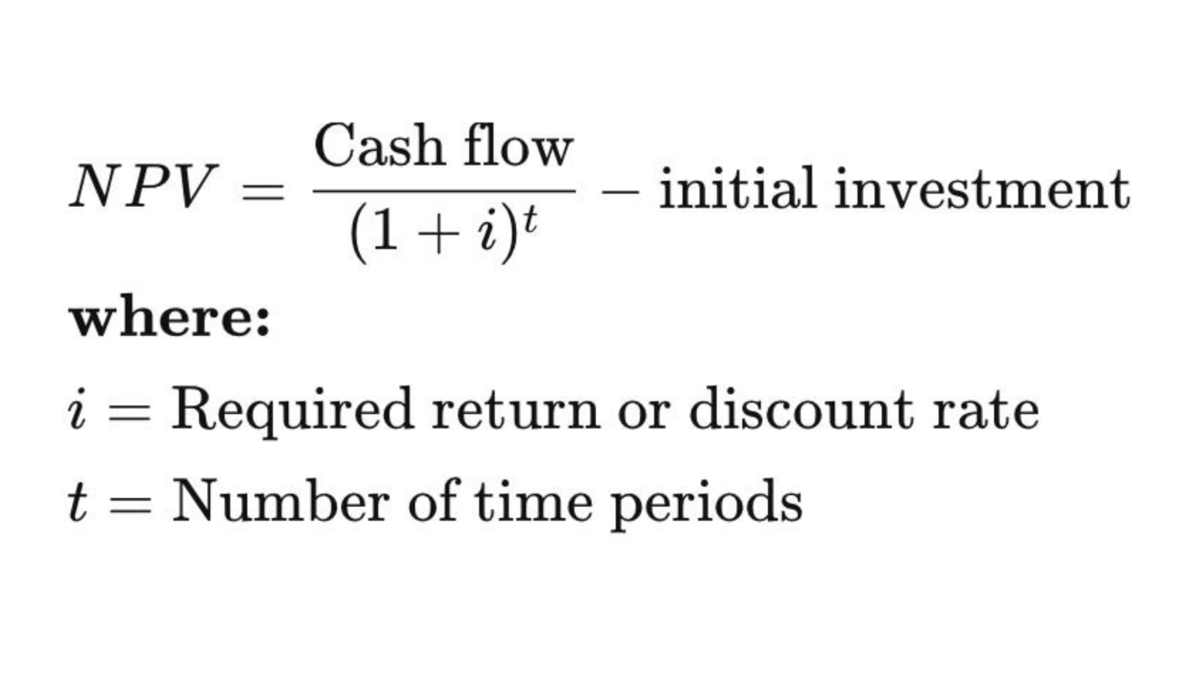

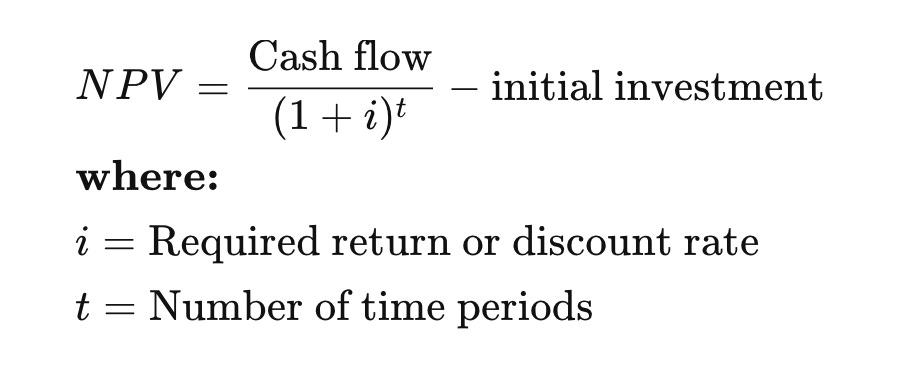

Net Present Value is a formula that is often used to make investment decisions. In short, NPV helps investors deploy capital in the most productive way by allowing them to compare two investment opportunities in an apples-to-apples manner. It considers the initial investment amount, the expected return or cash flow of the investment, the time it will take to realize that return, and compares it to a clearing rate know as the discount rate. While operators in SaaS probably haven’t thought about NPV since Finance 101 or Business School, we’ve lived – both on a micro and macro level – the capital allocation shifts that have undoubtedly been highlighted in many NPV calculations over the last 24 months.

By now, all of us have heard the “get fit” mantra that has been stressed from boards through to popular podcasts, and we’ve felt the consequences through layoffs, frozen hiring, or pressure to reduce spending in an effort to control burn. As deeply personal as these measures often feel, in reality, they are nothing more than a trickle-down from macro shifts in capital allocation. Nowhere is this more apparent than in publicly traded technology stocks.

Through a period of low interest rates, investors were willing, in the absence of lower risk or higher returning short-term investment opportunities, to pay a significant premium for returns with more risk further into the future. Many public technology companies have long hovered between being profitable and not, and have invested in projects and functions with longer return horizons. Given the broader financial environment, this was appropriate and it was rewarded.

As interest rates rose quickly through 2022 and into 2023, suddenly investment opportunities that were once less attractive in a very low interest rate environment now looked more appealing with NPV equations to match. Paying forward multiples for a tech stock with a return many years into the future started to make less sense to investors who could now achieve returns in places with less risk and/or shorter time horizons. Tech companies responded by beginning to cut costs quickly in order to become profitable or more profitable immediately, rather than in the future. They adjusted their strategies to meet the needs of their shareholding stakeholders.

Long before the recent macro shift, as operators in tech companies, NPV, while not always explicitly called out, has guided the trade-offs made in almost every management decision we make.

If you’ve been working in a tech company for more than a minute, you know that there’s always tension between Sales and Marketing, and to a lesser extent, between Sales and Customer Success. While some of this tension might stem from a clash of personalities, at a deeper level, it’s fundamentally about NPV trade-offs. Sales, driven by the relentless pressure of quarter-over-quarter targets, operates with an acute awareness of the rapidly approaching maturity date for their efforts – the ever looming end of the quarter! Although long-term planning is important, especially in sectors with extended sales cycles, the primary focus in sales, outside of the C-suite, remains on closing opportunities for the current quarter and building a pipeline for the next. This urgency leads Sales to constantly pressure Marketing for more leads; in their view, there are never enough, and they can never arrive quickly enough.

Marketing, fully aware of Sales’ needs, navigates a dual timeline. They must strike a balance between future-facing activities, such as brand building and positioning, and performance-driven, lead-based activities with a more direct connection to immediate revenue. Sales will often push for more effort against the latter, while Marketing knows that if they don’t do the higher-order brand work, there may be no foundation for the much-needed leads in the future. You could argue that the reality of the tension is rooted in NPV; Marketing has a longer time horizon for their efforts, which can obscure the present value of their investments.

In this mix, Customer Success often feels like the younger sibling of two highly competitive older siblings. When it comes to budget allocation as a function, we're at odds with both an impact on margin and the core nature of sales, which functionally boasts a strong NPV equation. How many times as a Customer Success leader have you gone into annual planning with a list of important needs only to get a budget for a fraction of these things while at the same time sales was granted all of their headcount requests – what gives?

The Productive Sales Rep Hurdle for Customer Success Spend

As a general rule, you can (or at a minimum should expect) a new sales rep to reach quota in at least one sales cycle; they should be productive in about half that time. In other words, if your sales cycle is 3 months long, then a rep should take one quarter to ramp. This truth underpins the NPV that other organizations fight so hard to get budget allocation for. If a sales rep starts to produce revenue within 3 months, beyond all but the essentials, this sets the baseline for time and output that all other investments should strive to beat. From my experience, the closer your proposals can get to the NPV of a sales rep, the better chance you have of getting budget approval.

Check out this NPV Calculator: Test your Customer Success Investment against The Productive Sales Rep Hurdle

Consider the widely accepted standard that allocates one Customer Success headcount for every $2 million of Annual Recurring Revenue (ARR). At face value it seems logical to dedicate one Customer Success team member to manage $2 million in ARR. However, what if there are doubts about the effectiveness of Customer Success? Maybe the CEO only believes that churn would only decrease by 10% without CS, does this mean that a single CS rep contributes only $200,000 (or less after you subtract their salary) over 12 months? If we overlook other intangible benefits, could this raise concerns about whether such an allocation of resources is truly optimal? While the above example is a gross simplification, I know more than a few Customer Success teams that have recently come up against this frustrating objection.

This is why it is so important for Customer Success leaders to know, understand and tie each of their projects back to a clear dollar based impact to the business. It is one of the key reasons I encourage teams to, one, be eager to step up in the organization and own an expansion target – as owning this responsibility has a high financial impact, and is one of the easiest to justify using NPV; and two, to invest in projects that require a one-time investment and that pay a return year over year, which also can creates a more validating NPV equation.

Use Net Present Value in 2024 Planning.

As you head into your 2024 planning try using the NPV calculator and consider structuring your proposals with NPV as a framework.

Ask yourself and your cross-functional colleagues the following:

- What is the expected return of this investment?

- How close does this investment come to clearing the The Productive Sales Rep Hurdle

- What are the risk factors; how sure am I that I can make this return, or how measurable is the impact of this program?

- How long will it take for this return to be realized?

Good luck in your 2024 planning and let me know how this works out for you!

If you liked this post, check out my last post: Customer Success is BS, and my collaboration with OnlyCFO, Do Customer Success Teams Add Value?

Like

Comments (0)

Popular